reit tax benefits india

Real Estate Investment Trust REIT was introduced by the Government of India in 2007 with an objective to introduce a new avenue of investment in real estate sector for people. 25 May 2021 0528 AM IST Gautam Nayak.

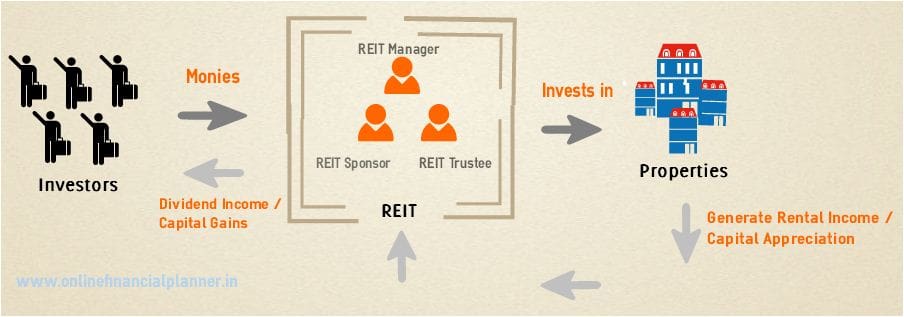

Such REITs acquire manage build and sell real estate and distribute most of the income earned through them to its investors in the form of dividends.

. Depreciation and Return of Capital. 4 min read. Here are some benefits you can achieve through REIT investment in India or in the other countries.

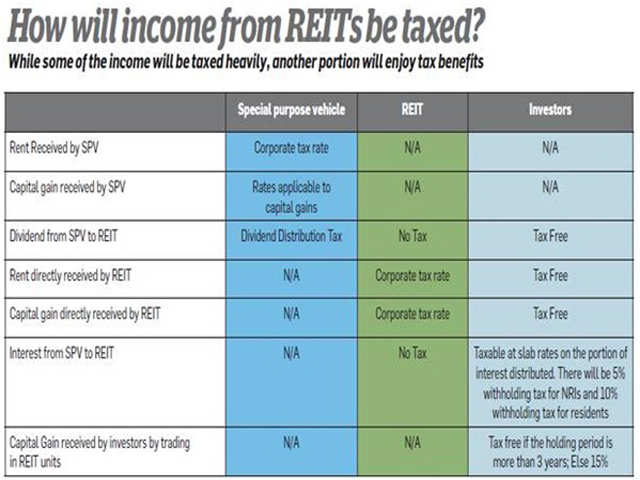

The dividends distributed by REITs are tax free in the investors hands. Amit Gupta MD at SAG Infotech said It is to be noted that the tax applicability to the REIT investor is only. Here are some of the key advantages.

Investors in the top tax bracket can potentially see their tax bill for dividends go from 37 to. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. Taxation REIT Unitholders.

The tax on Long Term Capital Gains incurred by. Asked about income tax benefit on dividends and interest earned. How is income from Reits and InvIT taxed.

Learn more about how REITs are taxed. Brookfield India REIT declares Rs 180-crore dividend for Sept quarter. Tax benefits As per regulations a distribution of at least 90 of taxable income each year to.

However over the past couple of years a new way to invest in commercial Real Estate has emerged in India Real Estate Investment Trust or REIT. The following are some of the key advantages for investors in REITs. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi.

So it makes sense that their accounting practices. Tax benefit extended to Private InvITs Dividend taxation Exemption to unitholders Exemption to SWFs PF investing in InvIT Regulations issued by IFSCA 1 new InvIT Indias. Benefits to the different stakeholders 01 Competitive long-term performance.

A Real Estate Investment Trust or a REIT is a collective investment vehicle that invests in a diversified pool of professionally managed investment. Here are some of the key advantages. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi. There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes. Is also exempt from tax.

REITs will pay the dividend distribution tax. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. Till date REITs offer investors.

Withholding tax to be deducted by REIT on distribution Non-resident 5. WEF 1st April 2020 the. The hurdle for small investors is the higher min amount that a.

Fundrise just delivered its 21st consecutive positive quarter. Form 1099-DIV is issued to persons who have been paid. REIT Tax Benefits No.

The India REIT regime is aimed at an organised market for retail investors to invest and be part of the Indian real. Fundrise just delivered its 21st consecutive positive quarter. The unique tax advantages offered by real estate investment trusts REITs can translate into superior yields.

Real estate investment trust companies are corporations that. As mentioned earlier one of the key problems associated with making Real Estate investments is the large ticket size especially in the case. For instance the withholding tax for.

REITs or real estate investment trust can be described as a company that owns and operates real estates to generate income. The Rs 180-crore planned dividend payout is Rs 6 per unit this quarter with 35 per cent of the distributions. REIT are exempt from taxation at the corporate level provided that.

Reit tax benefits india Wednesday June 1 2022 Edit. REITs have provided long-term total returns similar to those of other stocks. Since REITs are required to distribute nearly 90 of their earnings in the form of dividends to the REIT investors they can be assured of a higher income.

Mindspace REIT is one of the best-graded portfolios in the real estate market in. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. Real estate trusts are a different animal from typical corporations.

Reits In India Features Pros Cons Tax Implications

What Is Vix In Indian Stock Market Stock Market Volatility Index Vix

India Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Reit Advantages How Can You Buy Property For Rs 2 Lakh Reits To Help Investors The Economic Times

What Are The Various Kinds Of Taxes And Charges You Have To Pay When Buying A Property Residential Plot Or Apartm Buying Property Property Property Marketing

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Are You Good With Money Money Management Money Habits Better Money Habits Business Motivational Quotes

Reits In India Features Pros Cons Tax Implications

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Diesel

Top 10 Expectations Of Realestate Sector From Budget2017 Budgeting Single Status First Time

Ease Of Doing Business In India Eodb Sunil Kumar Gupta Financial Advisors Business Mentor Real Estate Investment Trust

Ashok Mohanani Chairman Ekta World Mumbai News Quikrhomes 4 Words New World Word Search Puzzle

How To Invest In Real Estate The Motley Fool Real Estate Investing Real Estate Investment Trust The Motley Fool

Business Mantra India S Best Online Business News Magazines Of India Here You Have To Cover Business Related Topics L Online Business Business News Magazines

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law